2026 Market (& Economic) Outlook:

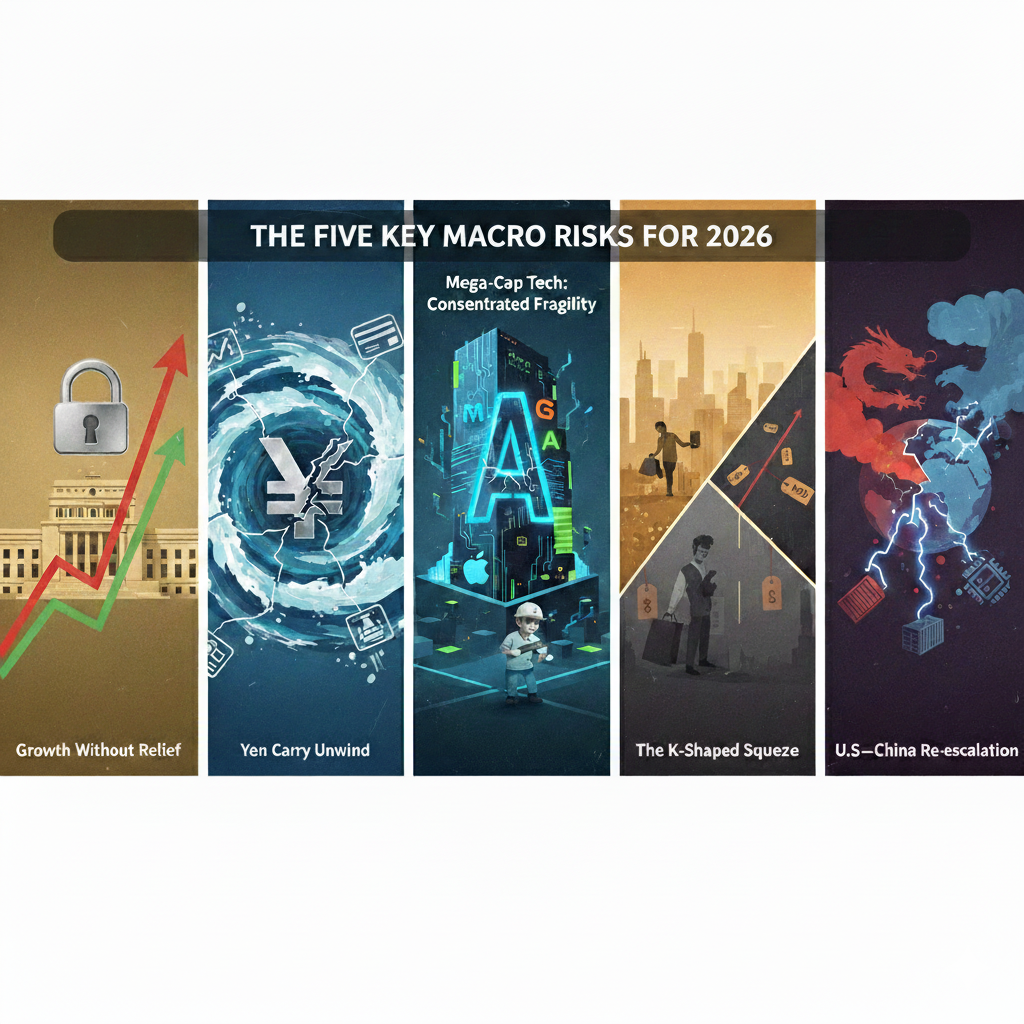

In this comprehensive presentation we explore the current macroeconomic, geopolitical landscape and investment trends shaping the year ahead.

As we enter 2026, we examine the shift toward a "multipolar world" and what it means for your portfolio.

We dive deep into the forces driving the economy, from AI capital expenditure to the impacts of fiscal policy and global geopolitics.

In this video, we cover: The Macroeconomic Backdrop: A look at IMF growth forecasts, US GDP projections, and the stabilization of the labor market.

Tariffs & Inflation: Analyzing how a 15.6% average tariff rate and stabilizing core services are influencing the Fed's 2% inflation target.

The AI Revolution: Evaluating the $500 billion CAPEX cycle from tech hyperscalers and the "productivity paradox" facing enterprises.

Investment Outlook: Why we are cautious about equity valuations despite "Goldilocks" hopes, featuring insights on S&P 500 concentration and historic valuations.

Fixed Income & Commodities: The outlook for US Treasury yields, the "canary in the coal mine" (Japan), and why we believe the gold bull run may be nearing a blow-off top.

10 Important Tax Benefits for 2025 & Beyond (OBBA)

With the One Big Beautiful Bill Act (OBBA) now fully in effect for 2025, several deductions and phase-outs have changed in ways that directly impact retirees, families, and high-income earners. Here are the 10 important tax benefits/tips to keep in mind.